The Road to Higher Education: Planning and Focusing On to Save for College

The Road to Higher Education: Planning and Focusing On to Save for College

Blog Article

Getting Financial Success in College: Practical Planning Tips for Trainees

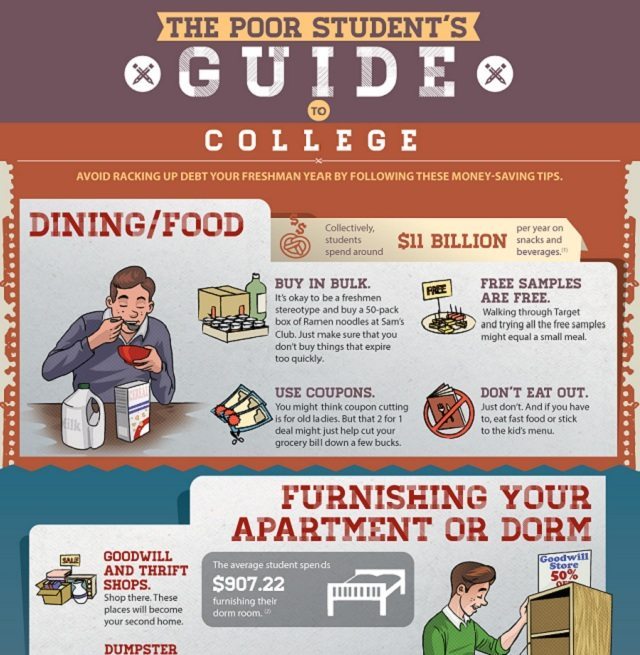

As tuition expenses continue to increase and living expenses add up, it is crucial for pupils to create sensible preparation approaches to accomplish financial success throughout their university years. From setting monetary goals to taking care of trainee finances, there are numerous actions that trainees can take to ensure they are on the appropriate track in the direction of a steady monetary future.

Setting Financial Goals

When establishing economic objectives, it is vital to be practical and specific. As opposed to simply aiming to save cash, established a details quantity that you intend to conserve each month or semester. This will provide you a clear target to work towards and make it easier to track your development. Furthermore, see to it your objectives are possible and realistic within your current financial scenario. Establishing castle in the airs can lead to aggravation and discourage you from remaining to function towards monetary success.

Moreover, it is very important to prioritize your economic objectives. Identify what is crucial to you and concentrate on those objectives first. Whether it is repaying student finances, saving for future costs, or constructing an emergency fund, understanding your concerns will aid you designate your resources effectively.

Creating a Spending Plan

This could consist of cash from a part-time job, scholarships, or financial help. It is vital to be complete and sensible when estimating your expenditures.

As soon as you have identified your revenue and costs, you can allocate your funds as necessary. Think about setting apart a portion of your revenue for emergencies and cost savings. This will certainly help you construct a safety and security internet for unexpected expenditures and future goals.

Evaluation your budget plan on a regular basis and make adjustments as required. This will make sure that your budget remains reliable and reasonable. Tracking your expenditures and comparing them to your spending plan will aid you identify locations where you can cut down or make improvements.

Creating a spending plan is an essential device for financial success in college. It permits you to take control of your funds, make notified choices, and work towards your monetary objectives.

Making The Most Of Scholarships and Grants

Taking full advantage of scholarships and gives can substantially alleviate the monetary problem of university expenses. Grants and scholarships are kinds of economic aid that do not require to be repaid, making them an optimal method for pupils to money their education. Nonetheless, with the climbing cost of tuition and fees, it is important for trainees to maximize their opportunities for grants and scholarships.

One method to maximize gives and scholarships is to start the search early. Lots of companies and establishments supply scholarships and gives to students, however the application due dates can be months in development. By beginning early, trainees can use and investigate for as lots of chances as possible.

Additionally, trainees must completely check out the eligibility requirements for each and every scholarship and give. Some may have details standards, such as academic achievements, community participation, or details majors. By recognizing the demands, trainees can tailor their applications to highlight their toughness and increase their chances of obtaining financing.

Additionally, trainees ought to think about using for both nationwide and local scholarships and gives. Neighborhood scholarships commonly have fewer candidates, boosting the possibility of receiving an award. National scholarships, on the various other hand, may supply higher financial worth. By expanding their applications, students can optimize their chances of safeguarding financial assistance (Save for College).

Managing Pupil Car Loans

One important aspect of browsing the economic responsibilities of university is properly taking care of student financings. With the rising expense of tuition and living costs, several trainees rely upon fundings to money their education. Nevertheless, mishandling these fundings can lead to long-lasting economic worries. To avoid this, trainees ought to take a number of actions to effectively handle their pupil financings.

First and primary, it is very important to comprehend the terms and problems of the finance. This consists of recognizing the rate of interest, settlement duration, and any type of potential fees or penalties. By recognizing these details, pupils can intend their funds as necessary and stay clear of any kind of surprises in the future.

Producing a budget is another crucial action in taking care of trainee finances. By tracking earnings and expenses, pupils can make certain that they designate sufficient funds towards loan settlement. This also aids in determining locations where costs can be decreased, enabling even more cash to be guided in the direction of financing payment.

Furthermore, pupils ought to explore alternatives for funding forgiveness or settlement support programs. These programs can supply relief for borrowers that are struggling to settle their fundings. It is essential to study and comprehend the qualification requirements and needs of these programs to make the most of them.

Last but not least, it is important to make prompt finance payments. Missing out on or postponing settlements can cause additional charges, fines, and negative influence on credit history ratings. Setting up automated payments or tips can aid guarantee that repayments are made promptly.

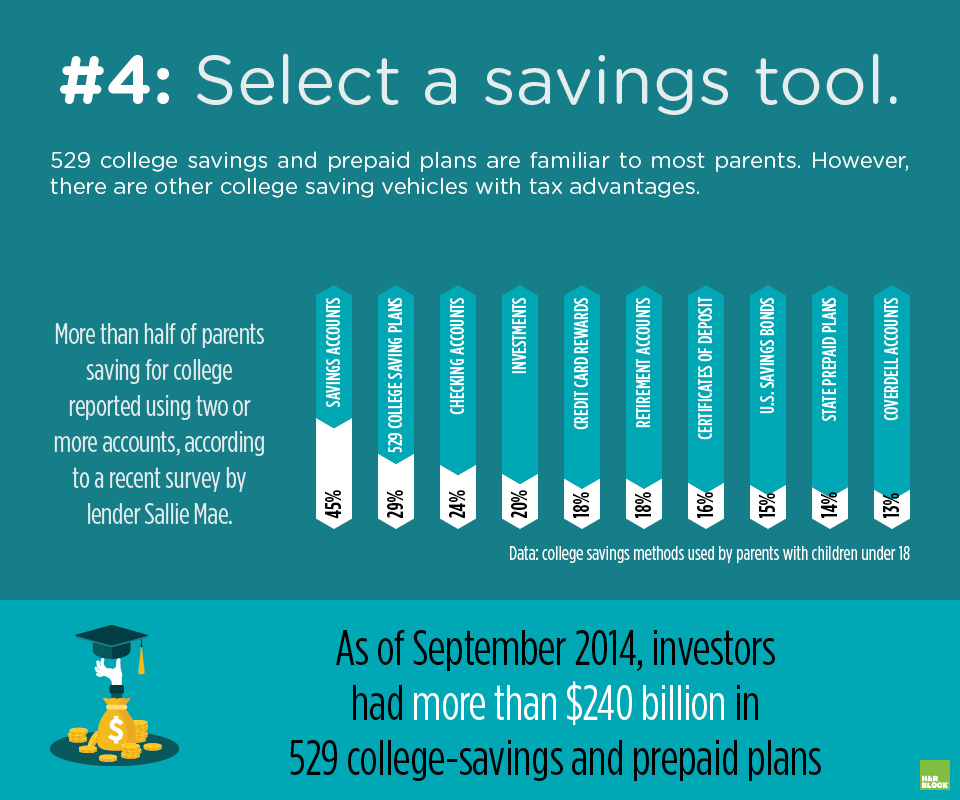

Saving and Investing Approaches

Navigating the monetary responsibilities of university, consisting of efficiently handling pupil lendings, sets the structure for pupils to implement saving and investing methods for lasting financial success.

Saving and investing methods are crucial for university student to protect their monetary future. While it might appear daunting to start spending and conserving while still in university, it is never too early to begin. By executing these approaches at an early stage, pupils can benefit from the power of substance interest and build a solid financial foundation.

Among the primary steps in saving and investing is producing a budget. This allows trainees to track their earnings and costs, identify site link locations where they can reduce back, and allocate funds in the direction of financial savings and financial investments. It is very important to establish certain monetary goals and create a strategy to attain them.

Another approach is to develop a reserve. This fund functions as a safeguard for unexpected expenses or emergencies, such as clinical costs or car repairs. By having a reserve, students can stay clear of entering into debt and keep their economic security.

Final Thought

In conclusion, by setting economic goals, creating a spending plan, taking full advantage of scholarships and gives, handling pupil car loans, and implementing saving and investing methods, university student can accomplish economic success throughout their university years - Save for College. Embracing these sensible preparation tips will assist trainees create responsible monetary routines and make certain an extra secure future

As tuition costs continue to increase and living costs add Discover More up, it is essential why not check here for trainees to establish practical preparation approaches to attain financial success during their college years. From setting monetary objectives to taking care of pupil lendings, there are various steps that students can take to ensure they are on the best track towards a steady monetary future.One important element of navigating the financial obligations of college is efficiently managing student lendings. To avoid this, trainees must take numerous actions to successfully manage their student car loans.

Saving and investing approaches are crucial for university trainees to protect their financial future.

Report this page